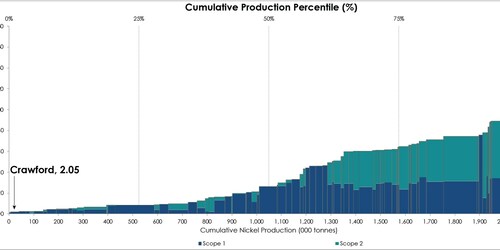

When in operation, Crawford is expected to produce 2.05t of CO2 per tonne of nickel-equivalent production over the life of mine. Canada Nickel said this is 93% lower than the industry average of 29t of CO2.

These results are based on a study by metals and mining ESG research company Skarn Associates, which applied data from Canada Nickel's preliminary economic assessment (PEA), the results of which were released on May 25.

Skarn Associates' proprietary E0 greenhouse gas (GHG) intensity metric relates to Scope 1 and 2 mine site emissions from the mining and processing of ore, plus fugitive emissions. It includes emissions from integrated smelting and refining facilities but excludes emissions from third-party smelting and refining. Emission intensities are stated on a recovered nickel-equivalent basis, calculated using average 2020 metal prices. Emissions are pro-rated across all commodities produced by the mine, based on contribution to gross revenue.

Importantly, its CO2 footprint estimate for the Crawford project does not include the carbon offset that Canada Nickel expects to be provided from the process of spontaneous mineral carbonation from the tailings and waste rock, which is comprised largely of serpentine rock that naturally absorbs CO2 when exposed to air.

Mark Selby, chair and CEO of Canada Nickel, said: "This study demonstrates that Canada Nickel's Crawford project can be a world-leading large scale, low-cost nickel supplier while possessing an extremely low carbon footprint.

"I am particularly excited that we can achieve this result even before we include the carbon offset potential from our waste rock and tailings which we expect to allow us to produce NetZero Nickel, NetZero Cobalt and NetZero Iron. These results reflect the mine's low strip ratio and our ability to utilise the low carbon hydroelectricity in the region and by using trolley trucks and electric shovels to reduce the consumption of diesel fuel."

Canada Nickel has applied in multiple jurisdictions to trademark the terms NetZero Nickel, NetZero Cobalt and NetZero Iron and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt and iron products. In July 2020, the company set up a subsidiary called NetZero Metals to develop a processing facility in Ontario for these products.

In January 2021, Canada Nickel signed a deal with Glencore to trial-use its Kidd concentrator in Timmins to lower initial processing costs for material mined from its Crawford project.