When it comes time to plan the construction or upgrade of a processing plant, mining directors have access to an abundance of information to help comply with safety, financial and environmental standards and regulations.

However, guidance on sound risk management and loss prevention strategies is often less prominent.

Mining companies are often unaware that they can consult their insurers on matters other than their insurance cover. Many insurers, including Vero, have specialised teams of risk engineers who can evaluate a project and suggest strategies to minimise risks.

Typical insurance cover

Mining insurance arrangements are typically tailored to each client’s needs, usually with the advice of an insurance broker. However, most mining projects will have a fire and perils insurance policy to cover losses caused by fires, explosions, natural perils such as cyclones and floods, as well as accidental damage, theft, malicious damage and arson.

Some clients choose to extend their cover to include a machinery breakdown endorsement, which, in simple terms, protects the client from sudden and unexpected failures of machinery or pressure vessels. Some also request business interruption cover, which can cover the loss of profit incurred while production is disrupted following an incident.

Evaluating risk

In order to establish an operation’s risk exposures, the client should first talk with their insurance broker and get advice on an insurance policy that is tailored to their needs.

Insurers will first assess the risks based on the information provided by the broker and then offer terms. However, in order to gain a more comprehensive insight, some insurers will also offer to send a specialist risk engineer to evaluate a site.

The engineers will evaluate the risks inherent to the operation and any established risk controls that help to prevent or minimise the impact of an event.

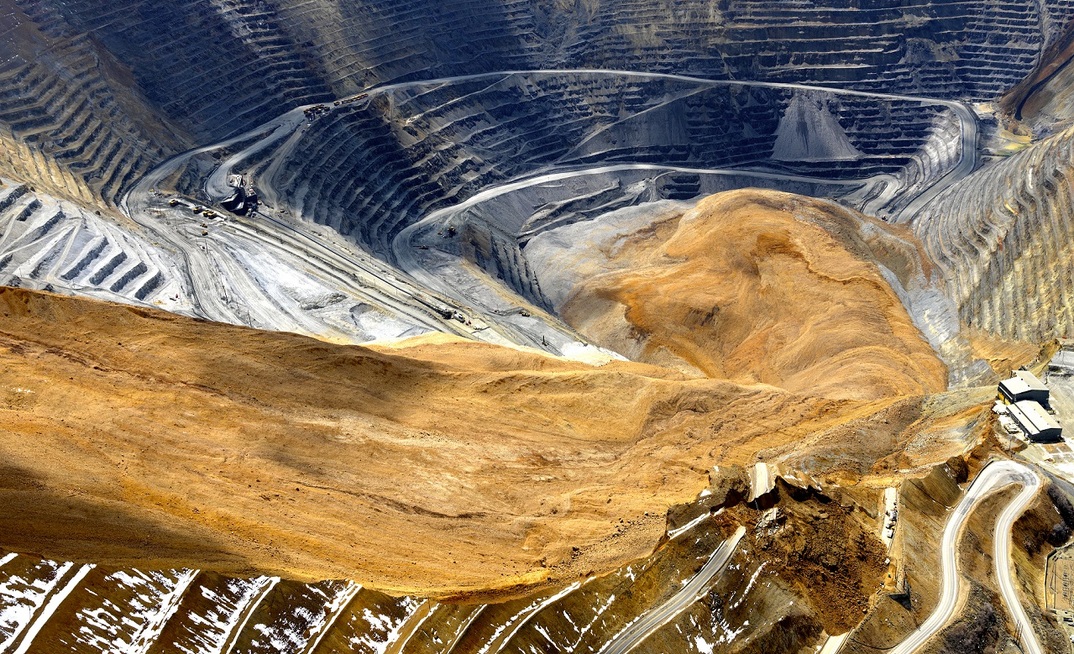

A dragline submerged by floods at the Ensham coal mine in Queensland, Australia in 2008

For example, the risks inherent with an operation include perils such as floods, cyclones and even earthquakes. Furthermore, the combustibility of building materials and the spacing between buildings and plant can have a corresponding impact on the spread of fires.

There are also hazards inherent with the process itself, such as potentially flammable or explosive chemicals, hot processes involving fuel-fired equipment, pressure vessels, and the use of combustible hydraulics or thermal oil.

The engineers will then examine plant design, fire systems and established procedural controls in place to counter the inherent risks.

Considering these exposures when planning the construction of a new facility or plant upgrades after a care and maintenance outage, can do a lot to improve a site’s inherent risk profile.

It is much more practical and cost effective to undertake these precautions during the construction phase, rather than retrofitting once the plant is in full-scale production.

For a long-established site, it’s usually very difficult and expensive to improve its inherent risk profile and retrofitting usually means costly disruption to production.

This is why, at Vero, we encourage our clients to consult us during these planning phases of a new facility or major upgrade works.

Suggested design strategies

For example, Vero would strongly recommend that critical assets like switchrooms are not constructed with combustible expanded polystyrene (EPS), or ‘sandwich panels’ as they are colloquially known. This material provides good insulation, but it’s not popular among insurers for good reason. It is easily ignited and burns very rapidly.

A space separation of at least 15m between critical non-combustible structures is recommended to reduce the risk of fire spread and possibly more when combustible structures are involved. Transformers should also be well separated from their switchrooms and adjoining transformers to lower the risk of fire spreading from a single unit failure. Blast separation walls are another measure that can be installed more cost effectively during the construction phase.

A lot of it is common sense too. For example, an above-ground plastic fuel line that gravity feeds a diesel power plant is not a good idea. A fuel farm fire could lead to a ruptured fuel line releasing burning diesel that freely flows downhill toward the power plant as well as any other assets in its path.

Similarly, running above-ground combustible plastic fire systems pipework alongside services through the processing plant is a bad idea. In the event of a fire, you’ll lose your fire water supply.

Hydraulics and lube pumping systems inside, or in close proximity to, electrical switchrooms, switchboards or hot processes are also ill advised. Ruptured high-pressure oil lines can release a fine mist of oil spray that is ignitable at temperatures well below the normal flashpoint temperatures, resulting in high-heat, torch-like fires.

If the system is compatible, fire resistant oils can be used as substitutes to help reduce the risk of oil spray fires. Other risk control measures include proper spill containment bunding to prevent flow of burning oils in a fire, or fire compartmentation methods, such as placing a thermal oil heater in a fire-rated plant room.

Electrical failures can be a major source of fires too. We keep an eye out for overloaded cable trays which can cause heat build-up, insulation damage and arcing between conductors. Well-spaced cables in covered cable trays with earth straps are a quick indicator that good electrical standards have been employed at the design and construction phase.

We would also advise that cable penetrations in switchrooms are sealed with appropriate fire stopping materials, and that appropriate lightning and surge-protection systems are provided.

Fire protection systems

Of course, insurers like to see comprehensive fire systems protection in all critical areas. The design of fire-fighting systems depends on the configuration of the facility.

Vero doesn’t normally recommend sprinkler protection for an open process plant, for example, because it’s often impractical.

However, we generally recommend that all critical switchrooms have full automatic fire protection, such as gaseous suppression. This is especially recommended when such switchrooms or switchrooms are constructed with combustible materials such as EPS. Suppression systems for hazardous processes, such as a production-critical hydraulic filter press, would also be encouraged.

As a minimum, processing plants should have a fire detection systems installed in critical areas with 24-hour monitoring in a central location, such as the main control room. We typically suggest the very-early smoke-detection apparatus (VESDA) fire-detection systems in these applications, since they help reduce response times.

We also recommend a dedicated hydrant system for process plant protection, but we often see systems that redirect process water to combine with the fire-fighting water supply.

These can be an acceptable alternative, provided the available water supply for firefighting purposes is guaranteed at the right pressure and flow and that piping configuration is such that inadvertent isolations of the supply are unlikely to occur.

Procedures and processes

Risk engineers will pay particular attention to emergency response procedures. A quick and effective response to a fire situation can mean the difference between a serious loss and a minor inconvenience.

A fire at the Hazelwood coal mine in Victoria, Australia, burned for 45 days in 2014

We review the emergency response team (ERT) training, drills and equipment, and examine the emergency response plans for natural perils like floods, cyclones, bushfires, as well as fires and explosions.

Regularly reviewed and properly documented systems, including operating procedures (SOPs) and work permit systems combined with formal training programmes, usually reflect a well-run operation.

Good control of hot work is critical too, particularly around combustible equipment like plastic screen decks and spirals, or rubber-lined equipment like tanks or ball mills.

Despite the best risk management efforts, losses can still occur and have a severe impact. That’s why it’s very important to have a good business continuity plan that aims to minimise site interruptions when an incident does occur.

Maintenance is vital

Maintenance is particularly important to prevent serious machinery failures. Insurers look favourably on operations that have regular, diligent maintenance practices, especially when machinery breakdown cover is included in the policy.

Many fires occur as a result of a machine failure, so good maintenance practices and procedures are important for fire and explosion prevention.

Transformer and electrical systems failures are good examples. A transformer insulation breakdown, can lead to a fire – or even an explosion – that spreads to nearby assets.

This is why it is crucial to test transformer oils, test earthing systems continuity and circuit breakers, and conduct thermographic scanning of switchboards to look for hot spots caused by loose connections.

It’s also good practice to regularly check safety devices, such as thermal oil heater pressure and temperature monitoring systems. This can help prevent machine failures as well as fires.

There are a range of additional maintenance procedures that are recommended, such as regular oil and grease sample analysis in critical gearboxes and ball mill girth gears. Non-destructive testing techniques, such as crack testing of gears and thickness testing of large tank walls, are also beneficial.

Insurers will also inspect the condition of structures. Indications of subsidence, cracking of concrete foundations and leaking tanks are all tell-tale signs of systemic plant condition issues.

It can take a long time to replace malfunctioning components or equipment – up to 12 months for a ball mill girth gear, for example – so it’s advisable to have a good inventory of well-maintained critical spares to minimise production disruption. Of course there are always cost limitations and holding optimum spares can be expensive. This is where contingency planning can be crucial to minimising downtime following a serious failure.

As you can see, risk management plans can incorporate a whole host of procedures, design strategies and equipment. Where practical, these are best considered at the planning phases of any major works. Vero’s risk engineers are more than happy to give guidance in these early stages to help avoid angst down the track.

As always however, the success of any risk management effort hinges on the relationship between client, broker and insurer. An open and collaborative approach will put you in good stead to minimising the risk of major losses.

Steve Butel is a specialist mining risk engineer at Vero Insurance, one of Australia’s largest insurers. See: www.vero.com.au