The use of data mining and analytics has been identified as one of the major innovation growth areas in the minerals industry. There have been many examples of the power these approaches can have in exploration, geological modelling, mine planning and logistics, but it has proven much more difficult to link disparate datasets in the mineral-processing plant.

Some of the best examples of data applications in the mining area are remote-operating centres, with Rio Tinto’s Mine of the Future programme allowing its operators to manage the automated mine fleet in its Pilbara iron-ore operations from a central facility in Perth, Australia. Other examples include centralised control centres that focus on management of all aspects of the mine and process plant, building towards fully integrated operation to improve productivity. These centres look to address issues with variability of feed that have a major impact on productivity and allow attention to be paid to interdependencies among parts of the system. This remains a management solution without specific drivers on data analytics for support but is an integral part of operations integration. Some examples of successful applications of central control centres include Barrick’s Veladero, Teck’s Highland Valley Copper, Codelco’s Andina and Anglo American Platinum.

While data mining and analytics are providing excellent productivity gains for front-end operations in mines, the applications in mineral processing have been less rapid. This is driven by the complexity of mineral-processing operations and the high degree of variability in process feed material. Even with integrated operations centres, tracking the variability of feed material based on processing parameters remains difficult. Most operations can analyse for variations in grade and some impurity elements, but relating this to process performance requires much deeper analysis. The problem for data analytics in mineral processing really is in this highly variable input, which makes modelling and analytics difficult.

In addition, disparate database technology, time scales and data types add levels of complexity to the problem that must be addressed before large advances can be made. Mineral-processing operations generate large amounts of data for very targeted applications. This comes from inputs such as on-stream analysers, flow and mass measurements, chemical assays and process-control information. However, most datasets are held in distinct databases, often proprietary, with no visibility between them. Further complexity is added with different time scales for measurements. These can range from second-based intervals for process control up to hourly or shift-based for chemical assays and daily, monthly and quarterly for traditional process mineralogy. Linking these presents a complex data-analysis problem.

To overcome this, a set of data is required that provides a link between different types of data and places them in context for the operation. It has long been understood that mineralogy provides this fundamental link through fingerprinting of material. Minerals drive processing behaviour and understanding where they are distributed in the process defines the effectiveness. Understanding the mineralogy provides a useful tool in linking the knowledge we have from all the disparate datasets in a mineral-processing operation. Changes in mineralogy drive everything from mill throughput to reagent consumption and even rates of wear for equipment.

End-to-end solution

The issue has always been that mineralogical analysis is slow, and even with excellent facilities turnaround times of weeks or months can be expected. A recent development, referred to as operational mineralogy, has been developed by MinAssist, with partners Zeiss and Petrolab, to reduce the turnaround time of the results from weeks to hours. This has been achieved through the development of an end-to-end solution incorporating on-site sampling, sample preparation, analysis and data interpretation within a 48-hour timeframe. This solution enables a paradigm shift in the management of the performance of mineral-processing circuits.

Operational mineralogy for process monitoringOperational mineralogy brings advanced mineralogical analysis techniques to site without the need for expert mineralogists. This allows a culture of mineralogical monitoring to be established. – Operational mineralogy programmes target key streams on the operation to focus on generating the right sort of data to address the questions raised. – Building mineralogical trends over time provides a concrete view of process health and the tools to rapidly identify processing issues. – Bringing analysis to site reduces turnaround time to 48 hours, making results relevant for day-to-day decision-making. – Mineralogical monitoring can rapidly identify solutions to existing problems and improve ongoing productivity, translating to significant value generation.

|

Operational mineralogy allows combination of the analysis of mineral particles with data from assay measurements and metallurgical test work, opening up new opportunities for value generation in the mining sector. The potential for this value generation has been estimated at US$370 billion annually (McKinsey Global Institute), with US$250 billion of this potential estimated to be through operations management (Metals and Mining Practice, November 2015, McKinsey), of which on-site automated mineralogy and operational mineralogy are a part.

Once a comprehensive dataset has been acquired for an orebody over a period of time, data mining can be applied for longer-term, more strategic improvements to the overall mining cycle. This can incorporate anything from improving the accuracy of the resource estimate, through to optimising the block model based on commodity prices and completing the cycle with further optimisation of the block model to take into account environmental management at end of life. This provides the operation with a tool to build effective geometallurgical models using real plant data, allowing for more effective mine planning, production forecasting and reconciliation.

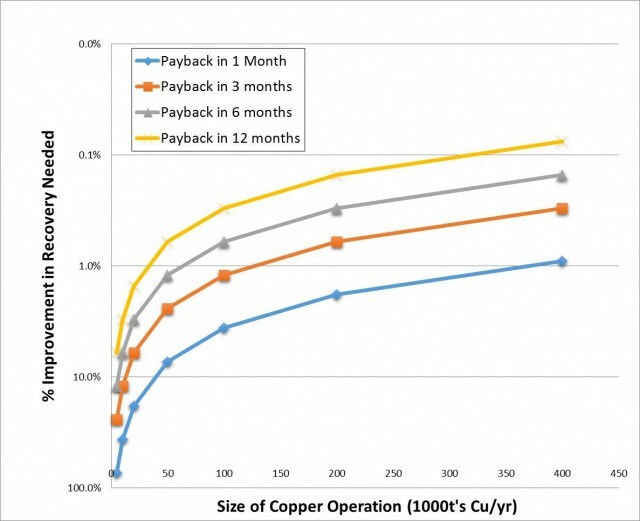

The return on investment of such a programme is clearly a function of the size of the mine and the price of commodities. Based on copper prices of December 2015 and an example capital investment of US$1 million, a large operation could expect to see a return on investment within three months if the programme identifies modest improvements in recovery of 1% of the total metal produced (e.g. the Kansanshi mine in Zambia – 300,000t/y of copper). For larger sites (e.g. the Las Bambas mine in Peru, which is projected to produce 400,000t/y copper), the return on investment is even more attractive with payback measurable in weeks rather than months (Figure 1).

Figure 1: The percentage improvement in recovery needed to payback an on-site automated mineralogy programme investment as a function of copper operation size

Efficient operation

Operational mineralogy, as a tool to utilise automated mineralogy directly in mineral-processing operations, provides a powerful avenue for process improvement and operational decision-making. With recent improvements in ruggedised automated mineralogy systems, such as those offered by Zeiss, and demonstrated implementation and value addition on large-scale copper operations, the routine use of mineralogical information as a process tool has become a reality. This will allow operators to make decisions based on more robust information and drive a paradigm shift in the use of data in mineral processing.

Building on the development of operational mineralogy, the use of trending mineralogy can form the link needed to enable use of disparate datasets in data analytics for better decision-making in mineral processing. This more effective use of data in the mineral-processing context is required to make a step change in the efficient operation of processing plants.

By making this information available in the near term (24-48 hours), operational mineralogy provides the tool to build mineralogical information into models and predictive algorithms. Through this, and in combination with chemical assays, on-stream analysers etc., operational mineralogy provides a rapid assessment of what has come into the process. The use of integrated control centres then allows this information to be fed back to the mine model and relevant processing information to be added to the target ore type or domain. In addition to the predictive capabilities, the use of operational mineralogy across key process streams allows assessment of mineral behaviour. With appropriate modelling software, such as MinAssist’s iMin (account) currently in development, the process of metallurgical accounting can then be extended to a mineralogical account.

Forward-thinking

The potential applications of improved data mining and analytics in mineral processing are wide ranging. In the first case, systems-based continuous improvement allows continuous evaluation of detailed process information for analysis of trends that can be directly translated into more effective continuous improvement. This is an immediate benefit from the use of operational mineralogy by quickly identifying key areas in the process that will benefit most from improvement projects. As trend-based mineralogical datasets are established to a level where process parameters can be related to the mine plan, the information can then be integrated into day-to-day decision-making, providing a powerful tool for operators to make more informed decisions. This can then be extended to the holy grail of better forecasting and reconciliation, where process forecasting can be based on fundamental material behaviour rather than a simple extrapolation of assumptions based on grade. Finally, given sufficient data quality, the data may be used in preventative maintenance planning through early identification of process changes that are unrelated to ore characteristics.

So given that the tools are now available, where will the solution come from? Many of the issues are well understood in other contexts and simply require a concerted effort to adapt to the mineral-processing requirements. Groups such as MinAssist are beginning to drive universal methods for linking datasets, and with the availability of operational mineralogy it will become easier to contextualise the data and apply the understanding in day-to-day decision-making. It does need forward-thinking operations willing to make their data available to gain a deeper insight into what is happening, but this is a great opportunity for those sites to seize the momentum and gain a great competitive advantage.

Dr Will Goodall is managing director at MinAssist, and Dr Ben Tordoff is head of mining and minerals at Zeiss. See: www.minassist.com.au and www.zeiss.com