Anglo Teck: A match made in ESG heaven?

Synergies and survival lie at the heart of the Anglo American/Teck merger – but sustainability is another driver behind the deal.

While the targeted US$800 million annual savings and asset base expansion were the headlines of the September tie-up announcement, the companies also highlighted their shared reputation as global ‘leaders in sustainability' and focus on social and environmental stewardship.

Both have shifted focus to ‘future-enabling' or critical minerals, and away from coal, with Teck selling its steelmaking coal operations last year (Peabody Energy terminated a proposed acquisition of Anglo's Australian coal business in August, following a mine fire in March).

So how do the companies stack up on sustainability?

ESG ratings

Both Teck and Anglo were strong performers in Mining IQ's inaugural ESG Mining Company Index last year, with Anglo placing fourth and Teck 24th out of the 61 large mining companies assessed.

While the full 2025 rankings are still being assessed, Mining IQ's research to date highlights some similarities and differences across four key ESG indicators.

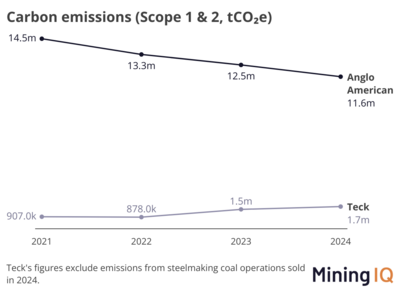

Carbon emissions

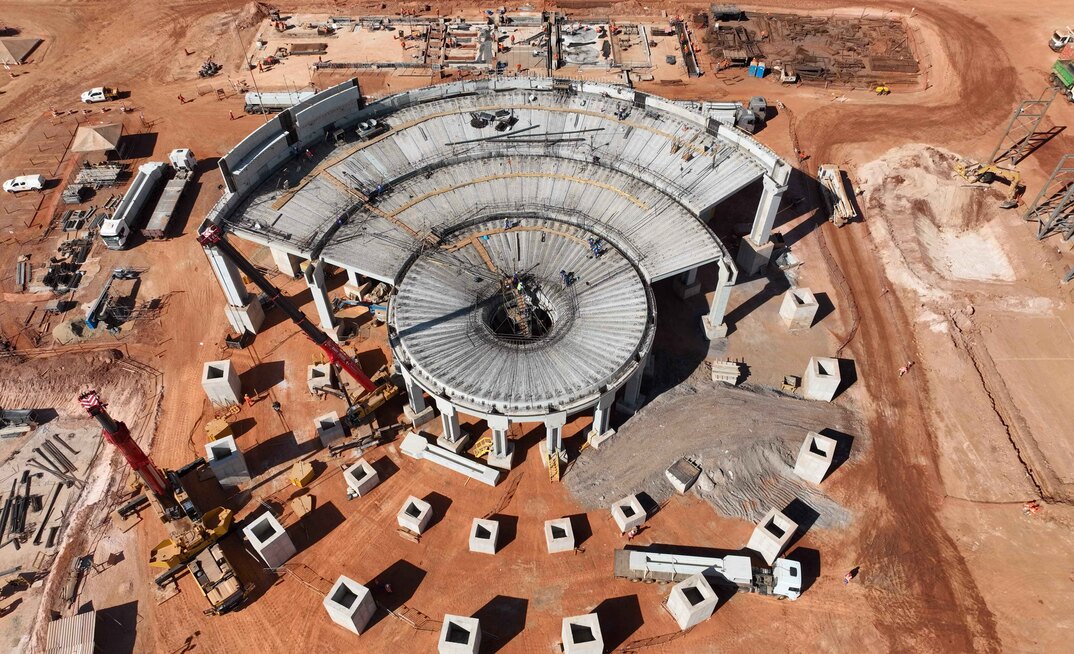

Anglo American is by far the biggest carbon emitter, reflecting its larger size and its product mix, with Scope 1 and 2 carbon dioxide equivalent (CO2e) emissions of 11.6 Mt in 2024, compared to Teck's 1.7 Mt (Teck's figure excludes emissions from its former steelmaking coal operations). Anglo's emissions have steadily but substantially declined, from 14.5 Mt in 2021, while Teck's have risen, in part due to the ramp-up of its Quebrada Blanca Phase 2 (QB2) asset in Chile in 2023.

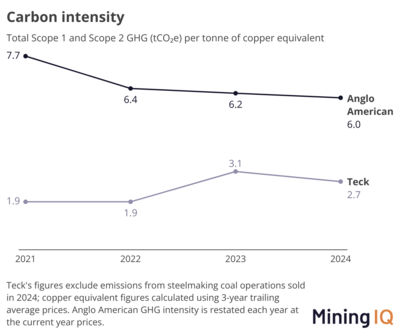

On an intensity basis, Teck's emissions are lower, averaging 2.7 tCO2e per tonne of copper equivalent in 2024, less than half Anglo's 6.0 t figure, but the comparison is not a fair one given the companies' different product mixes. Scope 1 and 2 emissions from Anglo's Copper Chile and Copper Peru businesses (at 0.36 and 0.23 Mt CO2e respectively) in 2024 were a fraction of those of its platinum group metals and steelmaking coal divisions (4.24 and 4.08 Mt), for example.

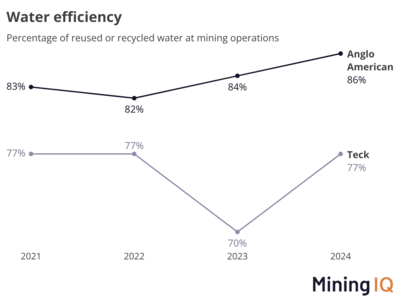

Water efficiency

Both companies were strong performers in water efficiency, with reuse/recycling rates far ahead of last year's ESG Index average of 52.6%. Anglo has maintained a significant edge over Teck on this front, with rates rising to 86% in 2024, compared with Teck's 77%.

Safety

Anglo also outperformed Teck on workplace safety. Anglo's total recordable injury frequency rate (TRIFR) was 1.6 per million hours worked, while Teck's was more than double at 3.3 (the two were fairly evenly matched in 2021-23).

While injury rates at Anglo have declined since 2021, Teck's TRIFR increased significantly in 2024, from 2.3 the previous year. A 43% fall in total hours worked in 2024, following the completion of QB2 in 2023, impacted year-on-year comparisons, Teck said in its 2024 Sustainability Report.

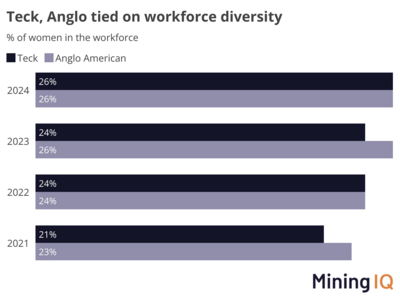

Workforce diversity

Anglo and Teck were evenly matched in terms of the proportion of women in the workforce, at 26% in 2024, and have performed relatively similarly on this metric since 2021.

Both are strong performers globally. The 26% figure is substantially higher than the 17% average recorded across the 61 companies in last year's ESG Index (which was based on latest 2023 data).

By Sam Williams and Celia Aspden

-

Share your views on mining risk – and receive free insights!

Mining IQ's World Risk Survey 2025 is now live. Rate up to three jurisdictions here to receive a free regional section of the report when it is published.

We would love to hear your feedback!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments about our research.