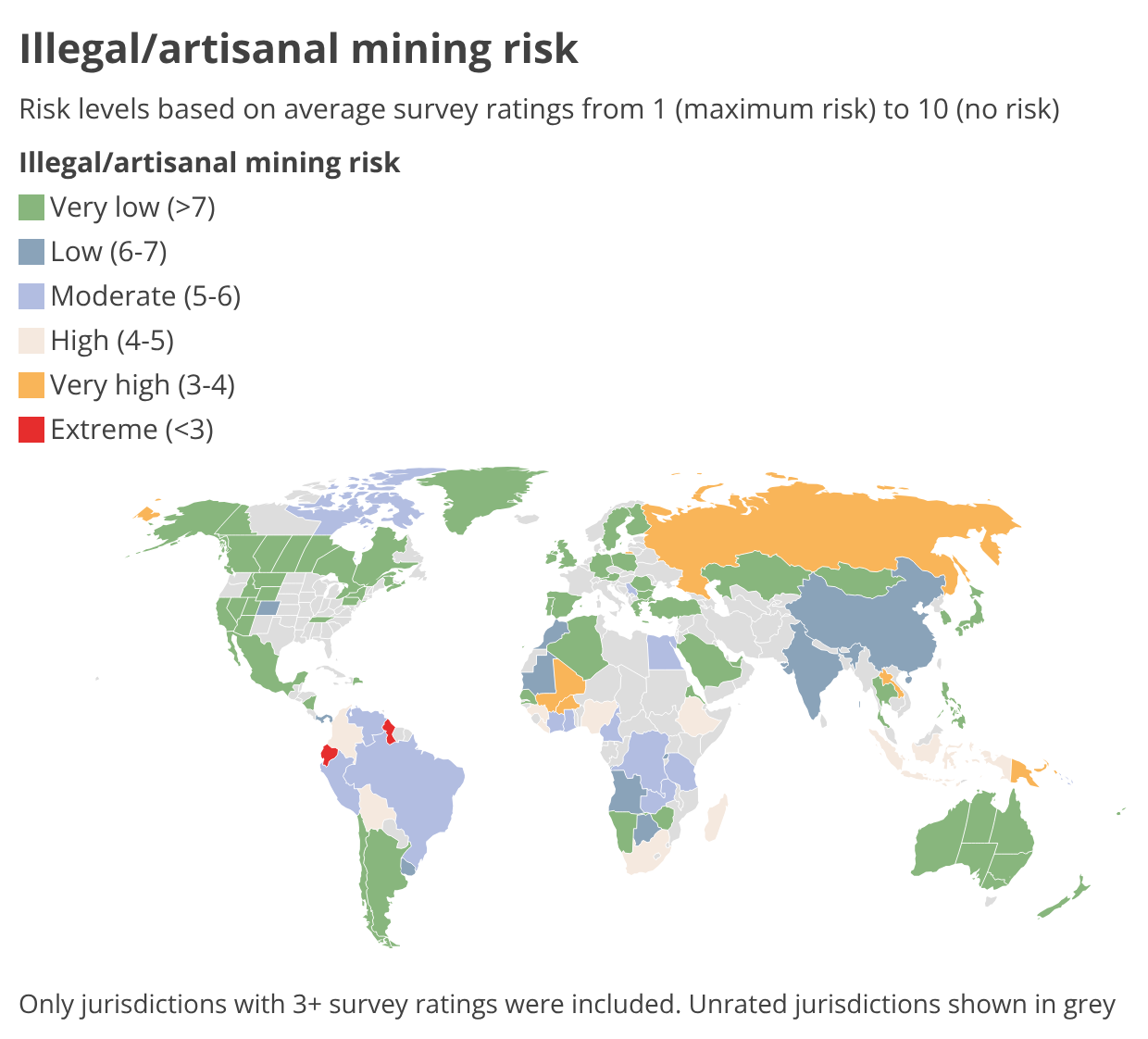

Mapped: Artisanal/illegal mining risks

Artisanal or illegal mining poses a major risk to the formal mining sector, with the threat highest in several South American and African nations, according to new research by Mining IQ.

The situation was assessed in Mining IQ's World Risk Survey, based on ratings from more than 600 industry professionals on risks in 120 jurisdictions worldwide.

While some large mining companies collaborate with artisanal miners – sometimes buying and processing ore and providing safety training – the presence of small-scale mining can create challenges for the industry, including disputes over land the risk of serious environmental damage from informal mining, a major cause of mercury pollution and deforestation.

Artisanal mining has a very poor safety record and can attract organised crime – something many World Risk Survey respondents reported.

In South Africa, at least 87 illegal miners died after an incident in an illegal shaft in Stilfontein last year, while Indonesian authorities issued fines totalling US$1.75 billion to mining companies operating illegally in state forests. Raythink, a China-based technology company, launched an AI-based thermal-imaging system late last year to detect illegal mining activity at an early stage.

Overall (not related to any specific jurisdiction), World Risk Survey respondents rated artisanal and illegal mining a significant risk to the formal industry, with 52.8% rating it seven or higher out of 10 in importance as a risk factor.

Artisanal or informal mining operations are present in more than 80 countries and provide an important source of income in many rural areas, employing between 10-20 million people globally, according to planetGOLD, a UN-backed program working to make small-scale gold mining safer, cleaner and more profitable.

World Risk Survey

The World Risk Survey, completed late last year, forms one element of the research behind Mining IQ's World Risk Insights report, with the 2025 edition due out soon.

In additional questions added this year, respondents were asked to rate risks associated with artisanal or illegal mining from 1-10, with 1 being the highest risk and 10 the lowest (or no) risk. Scores were based on the average of all ratings for each jurisdiction (only those with at least three survey ratings were assessed).

Artisanal/illegal mining: Extreme risk (<3.0)

Just two jurisdictions out of 99 assessed fell into the ‘extreme' risk category, with average scores below 3.0. Guyana was the highest risk, with an average score of 2.0.

Guyana has a long history of small-scale mining, which accounts for 70% of the country's gold output and employs more than 15,000 people, according to planetGOLD. Uniquely among gold-producing countries, artisanal mining is fully legalised in Guyana.

But small-scale mining is the most significant driver of deforestation and the largest source of mercury emissions in the country. One survey respondent said safety standards in Guyanese artisanal mining were extremely low, with no penalties issued to mine ‘owners' for accidents.

Ecuador was second, at 2.8. Small-scale mining in Ecuador dates back at least to the 1500s and is estimated to employ up to 20,000 people (directly or indirectly), according to planetGOLD. But several survey respondents said criminal gangs were now involved and profiting from it. "Organised crime…, coupled with the gold price, are the factors contributing to the significant increase in activity," one CEO of a Canadian company said.

High risk (3-5)

Four countries shared the third spot for risks relating to artisanal or illegal mining, with average scores of 3.0, including neighbouring West African nations Burkina Faso and Mali.

Several survey respondents said criminal gangs and terrorist organisations were exploiting small-scale mining in both countries, while one said Russian private military company Wagner was also involved in Burkina Faso. Concerns have been raised about child labour, environmental damage and poor safety practices in West African artisanal mining operations.

Laos and Russia also received average scores of 3.0. In Laos, powerful political families are commonly involved in informal mining, one survey respondent said. Papua New Guinea ranked seventh globally, with an average artisanal mining risk score of 3.3. Most activity centres around alluvial gold mining.

African and South American nations also dominated among jurisdictions scoring 4-5 on a 1-10 scale (lower scores indicate higher risk).

These include Madagascar, Nigeria and Colombia, all of which host large numbers of informal miners, along with South Africa and Indonesia.

In Colombia, with an average risk rating of 4.1, about 350,000 people rely on artisanal mining, mainly in remote, rural areas. Most artisanal mining operations (63%) are informal, lacking a legal mining concession or title, leaving mining groups vulnerable to organised crime gangs that launder illicit funds through the gold trade, according to planetGOLD.

Several survey respondents said organised criminal gangs and former paramilitary and guerrilla forces were involved.

Moderate risk (5-7)

African and South American countries also dominated the moderate-risk pack, including Brazil, Peru, Côte d'Ivoire, the Democratic Republic of the Congo, Ghana, and Cameroon. But jurisdictions from other regions crept in, including Nunavut, where artisanal mining and quarrying are focused on carving stone, and Serbia, which hosts small-scale operations targeting copper and other metals. (both scored 5.5).

Low risk (>7)

Most Canadian, Australian, European and US jurisdictions ranked in the low or very low risk categories.

By Sam Williams

Have your say on our research!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments.