Ontario retained its position as the world's lowest-risk mining jurisdiction in Mining IQ's World Risk Insights featuring MineHutte ratings, with Finland surging to second.

The report, produced by Aspermont research division Mining IQ and partner and legal consultants MineHutte, rates mining investment risk across six categories - Legal, Governance, Social, Environmental, Fiscal and Infrastructure.

• Join us for a discussion of the report's key findings and broader analysis in a free webinar, Mining Risk, Reality and the Fast-Evolving Geopolitical Order, on Monday (February 16). Sign up here

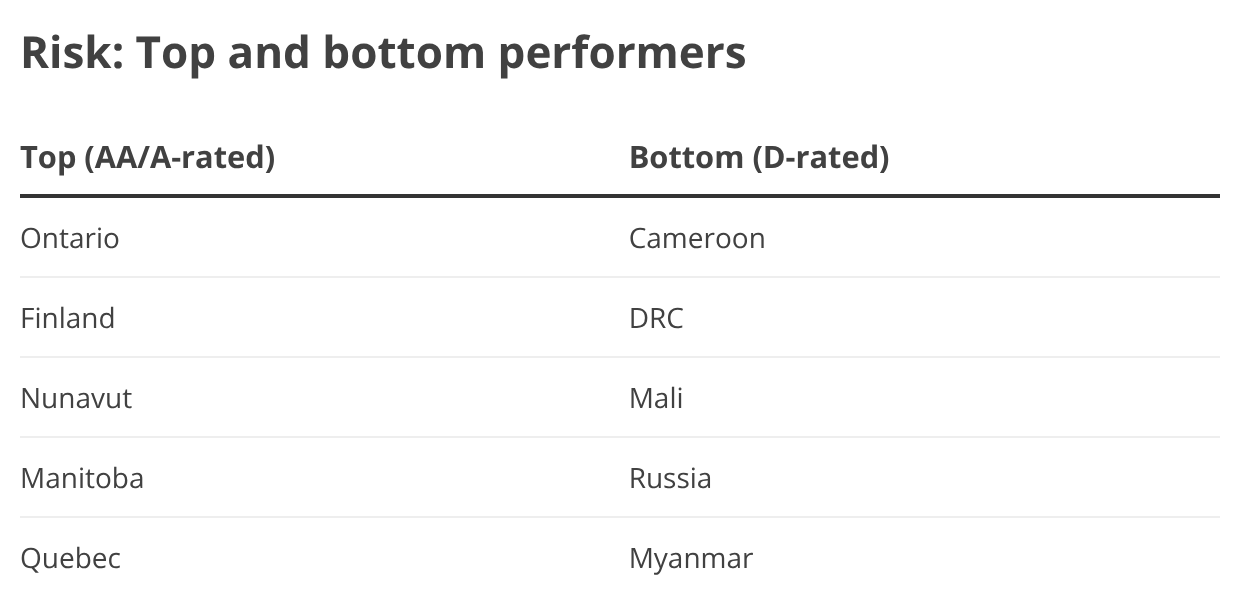

In the 2025 edition published this month, Ontario came top out of 120 jurisdictions assessed, with an Investment Risk Index (IRI) score of 75.2 out of 100, equivalent to a rare AA rating, or very low risk (the IRI is the report's overall risk rating, with higher scores meaning lower risk).

Ontario's scores were up from 74.0 in 2024, driven mainly by gains in the Governance, Social and Fiscal categories (Ontario also ranked top in 2024).

Finland's gains were more dramatic, with IRI scores rising about six points to 73.6 (an A rating, meaning low risk), taking the country to second place from 18th in 2024 (out of 117 jurisdictions assessed that year).

Improvements were mainly due to higher Legal scores following significant changes to the primary mining legislation over the past two years.

Canada dominates

Canadian provinces made up five of the top six jurisdictions in 2025. Nevada was the top-ranked US state, and seventh overall, with a score of 72.2 (A rating).

Western Australia – the top-ranked Australian jurisdiction – placed 21st, with a score of 66.9 or a BBB rating (low to moderate risk). Australian states and territories consistently underperform Canadian and US jurisdictions, largely due to weaker Legal scores that reflect higher levels of discretion in legislative drafting, according to MineHutte.

Highest risk

Myanmar was the highest-risk jurisdiction in 2025, with a score of 30.2, deep into the extreme-risk D-rating territory, for jurisdictions scoring below 40. Russia was second followed by Mali.

Our approach

World Risk Insights assesses risk across six categories comprising more than a dozen individual indicators. Risks within each category are evaluated across two elements: Hard Risk, based on more than a dozen ‘hard' data-driven indicators, including MineHutte's Regulatory Risk Ratings; and Perceived Risk, based on results of Mining IQ's annual World Risk Survey.

More than 600 mining professionals participated in the 2025 survey, making it one of the largest of its kind in the industry.

World Risk Insights 2025 is available for free with a Premium Mining Journal subscription. To purchase the report, enquire about subscriptions or download a free excerpt, click here

• Join Mining IQ editor Sam Williams, MineHutte COO Emma Beatty and Mining Journal's Siobhan Lismore-Scott and Will Clarke for a free webinar, Mining Risk, Reality and the Fast-Evolving Geopolitical Order, on Monday February 16 at 2pm GMT, for an analysis of the World Risk Insights findings and a discussion about how mining companies can make strategic decisions in a fast-changing global geopolitical landscape. Sign up here