Mining companies are delivering measurable improvements across core environmental, social and governance (ESG) areas, even as scepticism about the term ‘ESG' itself grows among industry professionals. This is the central paradox highlighted in Mining IQ's ESG Index 2025, the second annual assessment of ESG performance across the world's largest mining companies.

The 2025 Index evaluates 65 global miners using more than 11,500 data points sourced from over 150 sustainability reports and annual filings. Performance is analysed across 11 indicators grouped into six themes: Safety, Water Management, Carbon Emissions, Diversity, Social Investment, and Land Disturbance.

Despite the sector's fractious relationship with ESG as a label, performance continues to improve in several material areas.

In safety, average lost-time injury frequency rates fell markedly from 2023 to 2024, one of the strongest signals of operational improvement in this year's Index.

Gender representation continues to inch upward across the workforce, while local procurement and community investment metrics show steady expansion, underscoring miners' efforts to strengthen local value chains.

In addition, water recycling rates climbed again this year, reflecting sustained attention to efficiency and scarcity challenges.

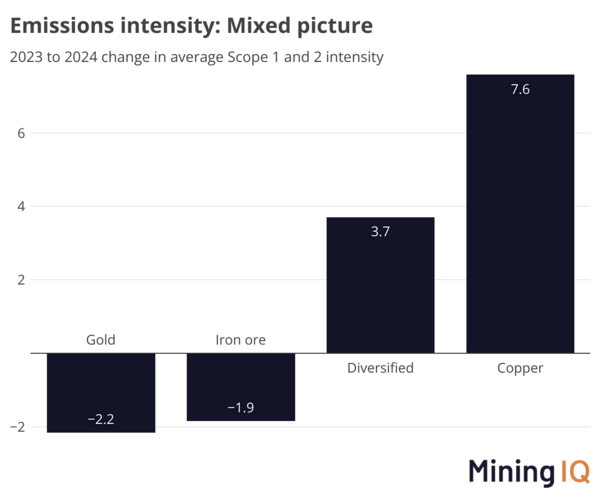

Carbon emissions: A slow mover

Progress on carbon emissions, however, remains uneven. Primary gold miners achieved a 2.2% reduction in average Scope 1 and 2 emissions intensity.

Primary copper miners saw a 7.6% increase, highlighting the complexities of ore grade decline, energy source mix and asset-level constraints.

ESG Index top performers

This year's Index spotlights top performers both across aggregate ESG performance and within specific themes.

Fortescue and Vale lead the overall ranking, each scoring close to 80/100, demonstrating strong, balanced performance across the weighted indicators.

BHP also stands out, particularly in terms of diversity. In an industry milestone, BHP became the first major global miner to reach gender parity across its employee base, defined as more than 40% representation of both women and men.

The ESG identity crisis

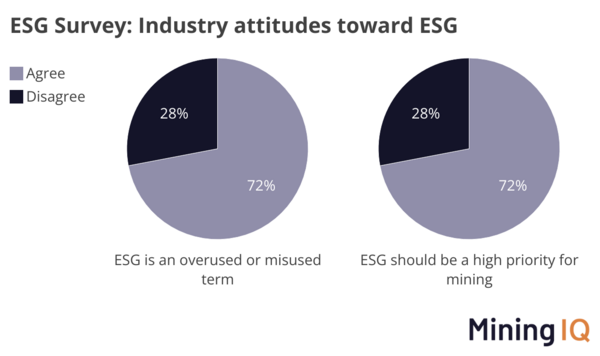

If the data shows growing momentum, sentiment tells a more conflicted story.

Mining IQ's ESG Survey, completed by 235 professionals, revealed widespread frustration with the term ‘ESG,' with 72% describing it as overused or misused, and 10% labelling it a distraction from the industry's core challenges.

Many critiques stem not from opposition to the underlying issues, but from the terminology itself; some professionals find ESG too broad, too politicised or unevenly understood. Others prefer alternative framing, such as ‘sustainability'.

Yet, crucially, these doubts coexist with overwhelming agreement on the importance of ESG issues themselves, with 72% of respondents confirming ESG is a high priority or the top priority for the sector.

ESG Index 2025

Mining IQ's ESG Index 2025, featuring full benchmarking of 60+ of the world's biggest mining companies, is available here (free for Premium subscribers).

Want to find out more? Watch our free webinar, ESG Fatigue vs. ESG Reality in Mining, which includes a summary of key findings and a discussion with special guests Robert Crayfourd (CQS/Golden Prospect Precious Metals) and Digbee founder Jamie Strauss.