Mining's 'patchy' local employment reporting

Most major mining companies are not reporting data on local employment, despite the key role jobs play in maintaining positive relations with host communities.

Out of 65 large companies assessed for Mining IQ's 2025 ESG Index, local employment figures were found for just 32, and there were significant discrepancies in the data. Many figures were not directly comparable due to varying definitions of ‘local', ranging from the community to national levels. Some companies did not provide a definition of ‘local'.

Creating well-paid jobs is one of the most important contributions mining companies make in local communities and host countries. Employment opportunities were identified as the most effective tool for maintaining local support in Mining IQ's 2023 Leadership Insight report, on the theme of Social Licence, selected by 76.0% of survey respondents, significantly higher than local procurement and social investment.

Local hiring and training will also play a part in addressing mining's tight labour market.

Local employment reporting

Mining IQ collected data on various ESG themes from 65 of the largest mining companies by market cap in August-October, including local employment. Local employment figures were found for 32 companies. Of these, no definition of ‘local' was found for 12.

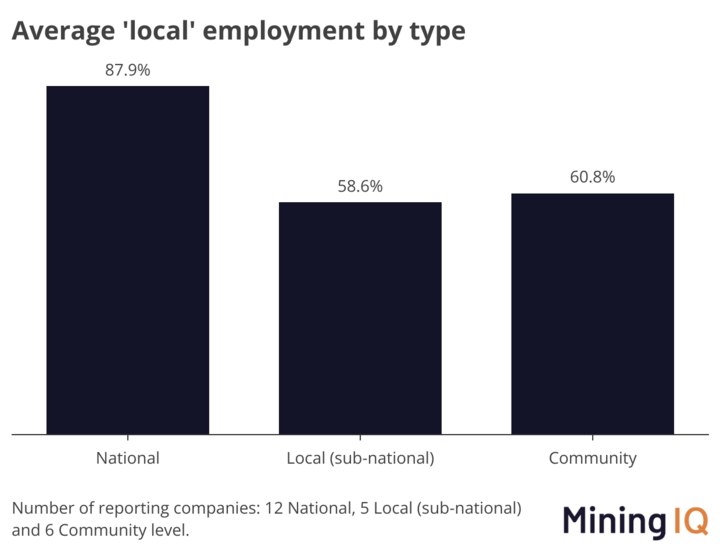

For those that gave definitions, data were divided among three broad groups:

- National employment (e.g., the percentage of South African workers employed at South African assets)

- Local (sub-national) employment, defined generally as workers employed from the sub-national ‘region' (such as Antofagasta region of Chile)

- Community employment (defined as employees from communities close to or affected by mining operations).

National level

Twelve companies reported National employment figures. The average National employment figure was 87.9%.

The highest figures were reported by Hindustan Zinc, at 100%, followed by Freeport-McMoRan, Minsur and Kinross Gold, at 99%.

Local (sub-national) level

Five companies reported data on a Local (sub-national) level (employees drawn from the region of the operation). The average was 58.6%.

Agnico Eagle Mines reported the highest Local employment figure of 67%.

Community level

Six companies reported community-level employment data, averaging 60.8%.

There was a wide variation in community employment figures, from Champion Iron's 3.0% to 91.5% reported by coal miner New Hope. Reasons for this variation are unclear from the company filings, but could include broader or narrower definitions of nearby or affected communities and variations of local labour availability or population size.

Most detailed data

Wider reporting is needed to build a more comprehensive picture of local employment in the mining industry, as well as more detailed publication of companies' definitions of ‘local' for employment purposes.

Among the 65 companies assessed, many provided no data, while many gave vague descriptions of their ‘local' definitions or failed to report them.

Three companies stood out as providing more detailed local employment data, releasing employment breakdowns on more than one ‘local' level. These were: Gold Fields (National and Community data), Hindustan Zinc, and SQM Litio (both reported National and Local figures).

Mining IQ's ESG Index

Mining IQ collected data on 65 of the largest mining companies by market cap for its forthcoming 2025 ESG Index, comparing performance across 11 indicators within six categories: Safety, Water Management, Carbon Emissions, Diversity, Social Investment and Land Disturbance.

Local employment data was collected as a possible additional indicator for the Social Investment category, but was not included due to the low level of reporting, by less than half the 65 companies, including many of the largest producers by market cap.

The Index is due out in December and will be available on the Mining IQ website.

By Celia Aspden and Sam Williams

We would love to hear your feedback!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments about our research.